A hedge fund is a financial investment fund that claims to bring profit in any market situation. Hedge funds in Israel are not subject to the joint investment law, since they raise funds from investors whose number does not exceed fifty and without contacting the public.

What does hedge fund insurance include?

Professional liability insurance for an investment manager – FIPI – will cover the fund for negligence in the provision of its services mainly, mistakes, omissions, negligent investment decisions and more. Professional liability insurance protects the hedge fund against various lawsuits and legal proceedings, among others, due to allegations of breach of the following obligations:

Negligence : Failure to exercise due care in providing advice or financial services

Misrepresentation: Providing false or misleading information to customers

Breach of duty: failure to fulfill obligations towards customers

Conflicts of interest : acting for interests foreign to those of the clients

Violation of laws or regulations

These exposures arise from the nature of their work which involves providing financial advice, managing transactions and handling confidential information. Professional liability insurance protects against these risks and helps the investment manager reduce the fear of lawsuits.

Directors and officers insurance – protects the officers against personal claims against them, filed by third parties, for negligence in the management and supervision of the business. For example: investor claims, claims from competitors and employer-employee relations claims.

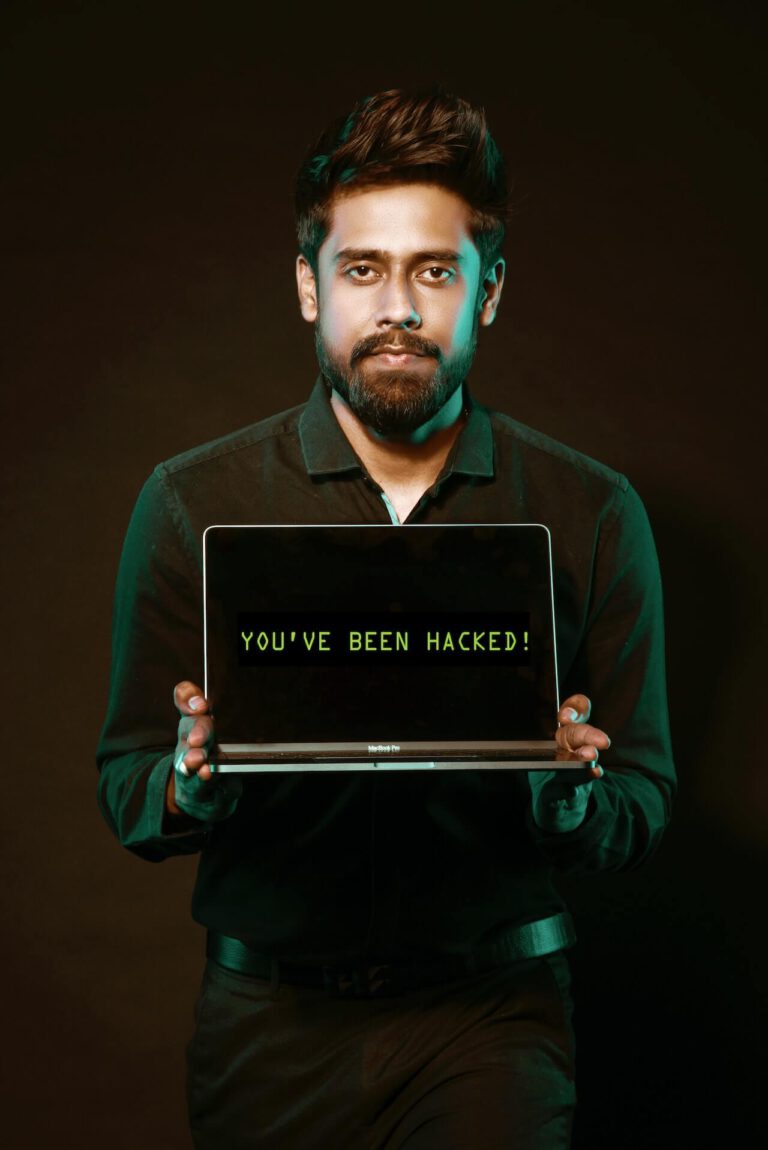

Cyber insurance – protects the company from third party claims as a result of a cyber incident, for example: claims for information leakage. The insurance also protects the company’s own damages as a result of a cyber incident (first party coverage): loss of income as a result of the incident, payment of ransom expenses, initial response team, payment of reporting expenses, expenses for regulatory investigations and more.